Nickel : 2018-2020 are likely to be nickel's years

Nickel 5-year spot price - Current price is USD 6.10/lb. Nickel is likely to do well in 2018 to 2020 as it recovers from a severe bear market.

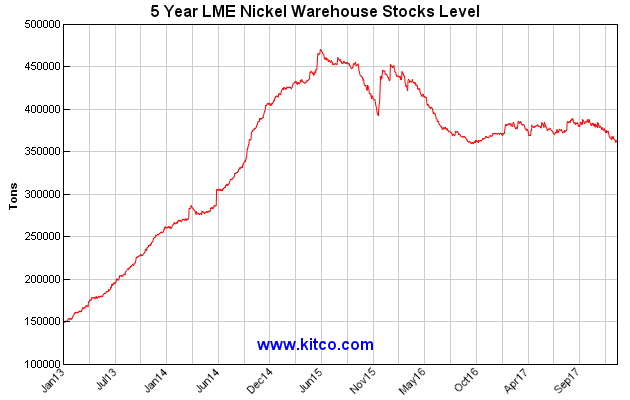

Nickel LME 5 year chart

2016 was lithium's year, 2017 was cobalt's year, and 2018-2020 are likely to be nickel's yearsas nickel inventories decline and nickel prices finally start to rise. Strong Chinese and global stainless steel demand and ever increasing demand from electric vehicles [EVs] using higher nickel content batteries NMC (8:1:1).

In this article the first 2 stocks are more solid and safe diversified nickel investments (with exposure to other metals) that will do ok even if the nickel boom is delayed until 2020.

The last 3 stocks are nickel-cobalt optionality plays that can give out-sized returns should the nickel price continue to improve as I expect. They will also be helped significantly by strong cobalt prices. In all cases investors will need some patience with a 5 year plus investment time frame.

Nickel price and inventory

Nickel is only just recovering now from a severe bear market from 2012 to early 2016 (low of just below US$4/lb), with the price moving up in 2017 and reaching USD 6.10/lb by late January 2018. Inventory is finally slowly declining and price is recovering. Whilst some Philippine supply is expected to come back, the demand picture is strengthening as global economic growth picks up and the mass market EV boom begins.

In 2017 nickel prices rose 27.51% on the back of solid Chinese stainless steel demand. I expect something similar each year from now until 2020, as demand is steadily boosted from the EV boom. Off course this assumes Chinese demand holds firm.

Nickel sulphide vs. nickel laterite ores

Nickel is only just recovering now from a severe bear market from 2012 to early 2016 (low of just below US$4/lb), with the price moving up in 2017 and reaching USD 6.10/lb by late January 2018. Inventory is finally slowly declining and price is recovering. Whilst some Philippine supply is expected to come back, the demand picture is strengthening as global economic growth picks up and the mass market EV boom begins.

In 2017 nickel prices rose 27.51% on the back of solid Chinese stainless steel demand. I expect something similar each year from now until 2020, as demand is steadily boosted from the EV boom. Off course this assumes Chinese demand holds firm.

Nickel sulphide vs. nickel laterite ores

Nickel sulphide ores generally have lower grades of nickel, but the nickel is easier and cheaper to extract. Also the ore is often founder deeper adding to costs of extraction. Sulphide ore has historically been the preferred choice, but easy to access sulphide ore is getting harder to find. Nickel sulphide miners are generally lower cost producers, and offer downside risk should nickel prices fall.

Nickle laterite ores are easier to find near surface, however the nickel is harder and more expensive to extract. Nickel laterite miners are generally higher cost producers, and are impacted more should nickel prices fall.

You can read more here.

Top 5 Nickel Miners To Consider Before The Nickel Boom

Nickle laterite ores are easier to find near surface, however the nickel is harder and more expensive to extract. Nickel laterite miners are generally higher cost producers, and are impacted more should nickel prices fall.

You can read more here.

Top 5 Nickel Miners To Consider Before The Nickel Boom

Κατηγορίες:

Σχόλια